After being ranked among the top five asset managers in Switzerland in the annual custody account performance comparison by BILANZ magazine for four years in a row, PostFinance has now reached the pinnacle. This top performance was rewarded with the title of “Best Asset Manager 2025” and highlights the high level of investment expertise – as reflected in the outstanding result in the Sharpe ratio, which measures the returns generated in relation to the risk taken.

E-asset management

You delegate, we deliver

You are here:

Don’t have the time or inclination to invest? With e-asset management, you can sit back and relax. Our team of investment experts will make your investment decisions for you and keep track of trends on the financial markets.

Function enhancement

You can now also subscribe to e-asset management directly in the PF App.

E-asset management: delegate investment decisions

-

Delegate your investment decisions to PostFinance’s experts

-

Initial investment from just CHF 5,000

-

Individual investment focus: Swiss, Global or Responsible

-

An attractive range of funds and exchange traded funds (ETFs)

Asset manager of the year – over 24 months

Explore how you can set up the e-asset management investment solution online and get an overview of the most important functions:

You can now also subscribe to e-asset management directly in the PF App.

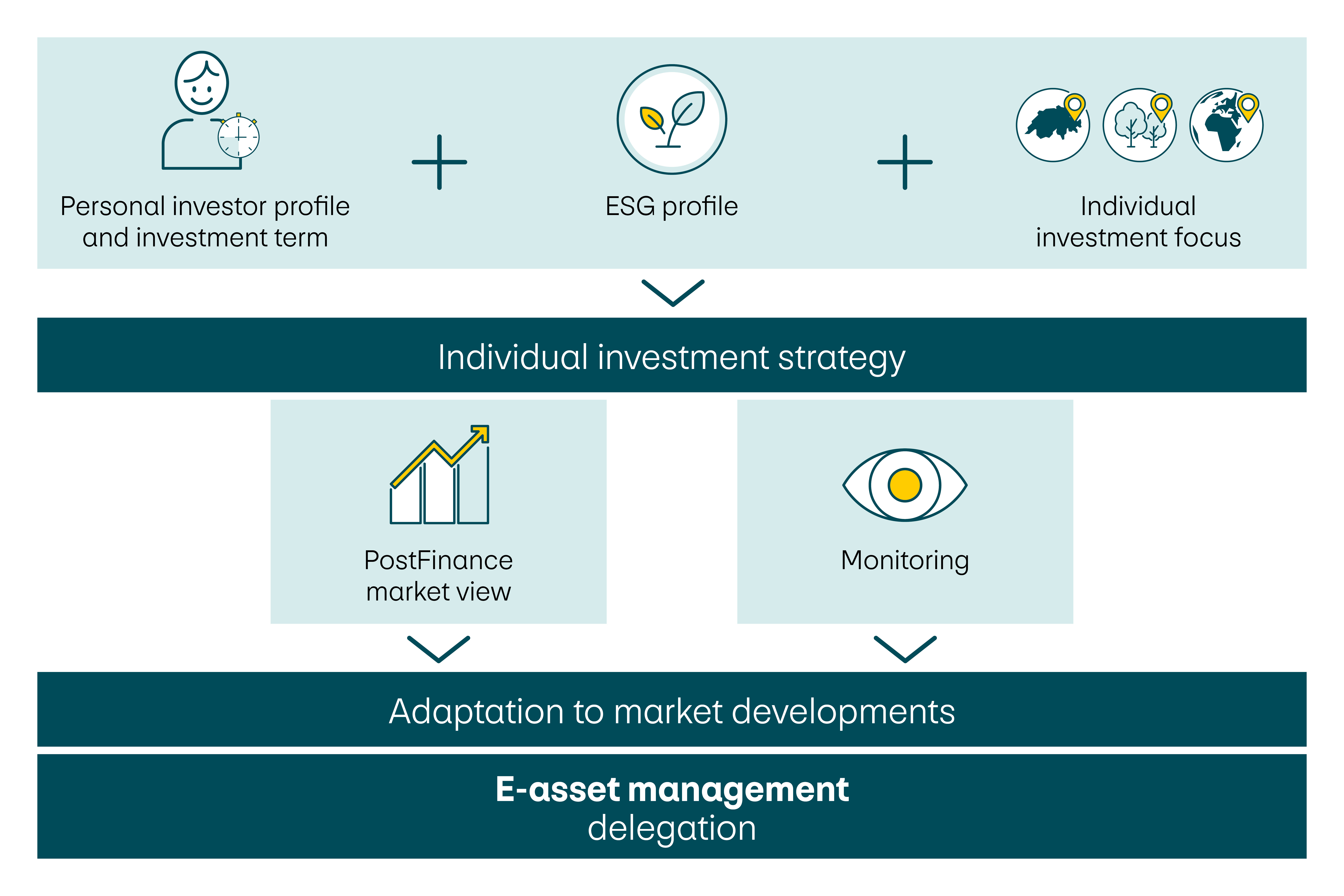

Based on your personal investor and ESG profile, your investment term and your chosen investment focus, we propose an individual investment strategy for you. This sets out and defines the ratio of different asset classes (liquidity, bonds, equities, alternative investments) and the ranges (bandwidths) within which they can move.

You choose an individual investment focus (Switzerland, Global, Responsible) to reflect your personal preferences in your portfolio. Through the ESG profiling process, you determine whether and to what extent we should invest in responsible and sustainable instruments for you.

Our market view is incorporated into your e-asset management based on current market developments and your investment strategy. You can rely on our investment experts to monitor and implement your investment strategy. From analysing the market environment to investing in our investment universe: our structured investment process ensures that your portfolio is always invested optimally and in accordance with your individual investment strategy.

Consulting and service

In e-asset management, we monitor your portfolio on a daily basis in line with the agreed investment strategy. In this way, we ensure that your portfolio is adapted to the relevant market environment as effectively as possible.

Upon request, you can benefit from the advice of our expert investment consultants. In your e-finance, you also have the option to view your portfolio and performance at any time and, if necessary, adapt your investment strategy or change the chosen investment focus.

Funds saving plan

You can increase the amount you invest at any time in e-asset management. You can choose between a one-off transfer and a standing transfer order. You can set up a savings plan using the “Standing transfer order” function.

Our market view

PostFinance’s investment committee analyses current market developments in detail to determine positioning. Adjustments based on market developments are implemented as part of your investment strategy. We ensure that any decision we make is in our customers’ interests, and we convey our positioning transparently in our monthly publication investment compass.

Investment is a personal matter. Set your own personal priorities and choose your individual investment focus: Swiss, Global or Responsible.

Swiss: a portfolio with a strong domestic focus

If you set your focus to the domestic market without neglecting diversification, you will benefit predominantly from the development of the Swiss market.

Global: the best the world has to offer

If you opt for a diversified global investment, you will benefit from differing economic cycles, interest rate levels and currencies.

Responsible: identify opportunities and minimize risks with ESG

Take account of environmental, social, and governance (ESG) criteria relating to the environment, society and responsible corporate management.

-

Focus Responsible (PDF) (PDF) The link will open in a new window

-

ESG report Focus Responsible (PDF) (PDF) The link will open in a new window

-

SCS (Suisse Climate Scores Report) Focus Responsible (PDF) (PDF) The link will open in a new window

-

“Responsible” focus in e-asset management and investment consulting plus (PDF) (PDF) The link will open in a new window

Further information on the investment process

In the video, find out how our market view is formed and incorporated into e-asset management in line with your investment strategy.

By carefully selecting and systematically checking each investment instrument, we provide you with an attractive investment universe. When selecting these instruments, we only consider actively and passively managed funds with no sales remuneration, as well as exchange traded funds (ETFs).

Service fee |

0.75% p.a. on the investment assets incl. investment account |

|---|---|

Price per year. Service fee on the average invested assets including investment account |

0.75% from CHF 0 p.a. 0.70% from CHF 250,000 p.a. 0.65% from CHF 500,000 p.a. 0.60% from CHF 1 million p.a. |

Sales remuneration |

None |

Minimum investment amount (initial investment and redemption) |

CHF 5,000 |

Minimum amount (follow-up investment) |

From CHF 0 |

Standing transfer order (savings plan) |

From CHF 0 at regular intervals (monthly, twice a month, every two months or quarterly) Please note that investment amounts of up to CHF 500 are generally only invested as part of the next rebalancing. |

Securities deliveries to third-party banks |

Not possible |

More information on fees

-

The investment strategy is based on your defined investor profile, which takes account of your preferred investment term and your risk appetite and capacity. At PostFinance, five possible investment strategies are used.

The link will open in a new window Investment process for e-asset management (PDF)

-

This is determined by how much risk you are willing to assume (risk appetite), the financial loss you are able to sustain (risk capacity) and what your preferred investment term looks like.

-

Yes. You can change your investment strategy at any time via e-finance or with an advisor.

-

You can view your portfolio and its performance at any time in your e-finance.

-

The minimum investment amount is CHF 5,000 for opening and redeeming an existing e-asset management.

-

Yes. Redemptions can be made from a value of CHF 500. The minimum investment amount of CHF 5,000 must remain in e-asset management after redemption. This means redemptions can be made in e-asset management from investments of CHF 5,500 or more.

-

Based on standard market comparative values and current market developments, the use of costs is set regularly in relation to the expected return.

-

With e-asset management, customers delegate their investment decisions to PostFinance. PostFinance invests their money on the financial markets and manages their portfolio.

-

Customers must indicate what financial losses they are able absorb. Their risk capacity is determined based on this information. Customers also indicate how much loss they are prepared to accept, which is known as their risk appetite. Additionally, customers indicate the investment term they would like and how important sustainability is to them. This makes it clear how heavily responsible and sustainable investment products are incorporated into the investment strategy, allowing PostFinance to take environmental, social and governance (ESG) issues into account when making investments. Customers can also choose a personal investment focus, such as “Switzerland”, “Global” or “Responsible”.

-

A portfolio is compiled based on the investor profile. The ratio of the different asset classes (liquidity, bonds, equities or alternative investments) and the range within which they can fluctuate are optimized.

-

The portfolio is monitored daily and adjusted based on the personal investment strategy and the current market conditions. PostFinance’s market view, which is created monthly by the investment committee, forms the basis for adjustment decisions. This positioning is communicated transparently in our investment compass monthly publication.

-

The “e” stands for electronic. However, e-asset management is not a digital robot solution. It can be opened online, and complex mathematical processes and data analysis methods are used to define and optimize the composition of the investment strategies. However, the analysis carried out by our investment committee, which is made up of human beings, always plays a key role.

-

PostFinance has been involved in the investment business for over 25 years and offers solid investment solutions.

Advice about financial investments

Get more from your money. Find the right financial investment in a consultation with our experts.