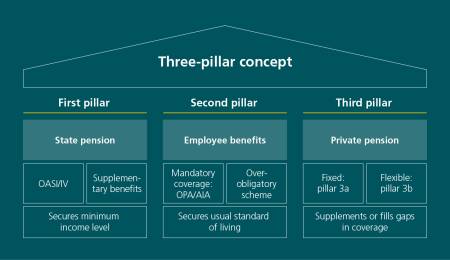

Pillar 3a: take control of your retirement provision and save on tax with a fixed pension plan

It is well worth taking control of retirement provision yourself rather than relying solely on mandatory contributions from state pension insurance. Pillar 3a is a particularly attractive option. As an employee with a pension fund, the maximum amount that you can pay into the third pillar is CHF 7,258 a year (as of 2025). This amount changes every few years, so check the current situation each year. Self-employed people can make higher contributions. The amount you pay in can be deducted from taxable income at the end of the year, so it’s worth contributing the maximum amount if you can.

However, even if you do not wish to pay in the maximum amount or are not in a position to do so, it is worth paying into pillar 3a, as even small contributions add up over the years. The tax-saving effect is therefore an important factor, independent of the current interest rate on the retirement savings account 3a. Note that pillar 3a is a fixed pension plan. This means that withdrawal is possible five years before reaching retirement age at the earliest and five years after that date at the latest. Early withdrawal is only possible in certain circumstances, such as financing the purchase of your own home.