Would you like to open your account together with another person? You can find more information about the partner account here.

Banking packages for adults

Open a Smart or SmartPlus banking package

You are here:

Do you want to make your payments and conduct your bank transactions easily, quickly, flexibly and securely? PostFinance's banking packages make it possible. Choose the products and services within the package in line with your needs.

Smart and SmartPlus: for daily banking

-

- Open online in a few minutes

-

- Accounts, cards and services bundled in a practical manner

-

- Free additional savings, investment and retirement savings accounts

-

- Debit card valid worldwide and online

-

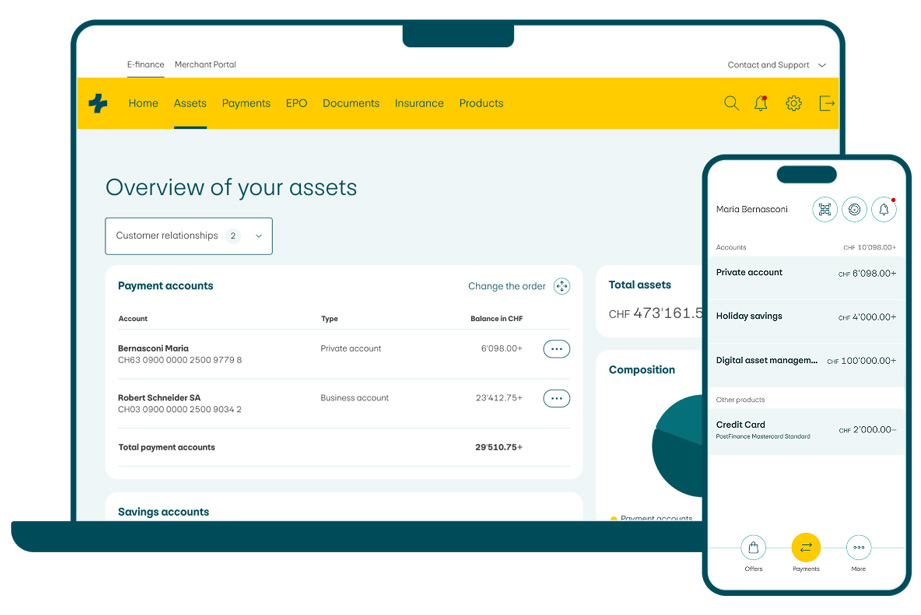

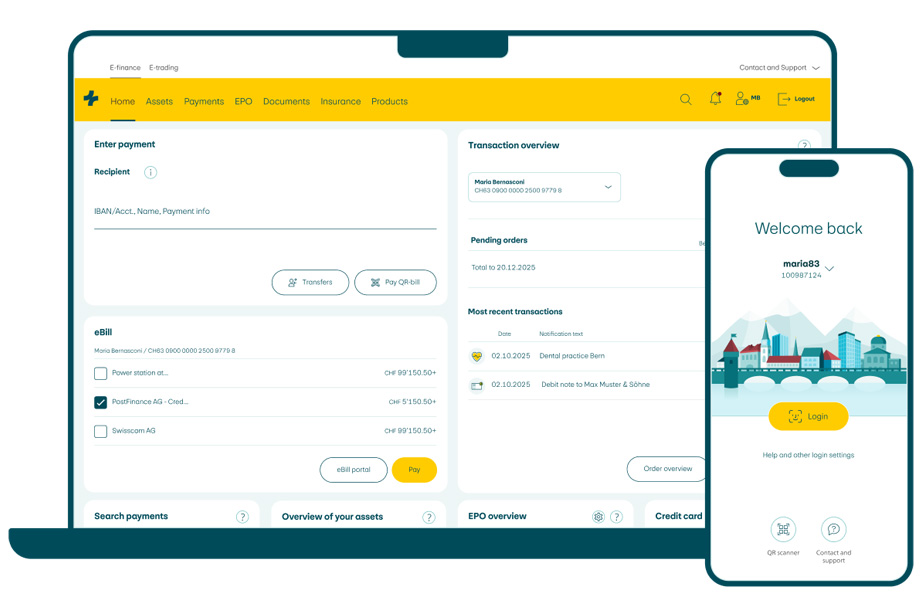

- Finances in e-finance and the app under control at all times

Choose your banking package

The banking package in just a few steps

- Choose your banking package and open it in around 10 minutes online or at a branch

- Compile the products within the banking package as you wish

- Verify your identity using your smartphone or on in person

- Access your accounts immediately and use your e-finance

- You will receive your PostFinance Card and any credit cards by post

More information can be found in the document The link will open in a new window “Services and prices for private customers” (PDF).

Banking package advisory tool

Do you want to know which banking package is ideal for your needs?

All you need for everyday banking

Questions and answers

-

No, private and savings accounts as well as the PostFinance Card and credit cards are available in banking packages. You can individually set which products and services are included in your banking package at any time.

-

Yes, your basic banking package includes a private account in CHF, EUR or another foreign currency as well as a savings account in CHF or EUR on request. You can open further accounts later in your e-finance individually and free of charge.

-

Thanks to the SmartPlus banking package, you benefit from a discount on all PostFinance property insurance such as car, motorcycle, travel and legal protection insurance. To benefit from this, the banking package must belong to you as an individual.

For each insurance policy, we grant you the respective discount once as a net premium (excluding taxes, duties, etc.). We credit the amount to your PostFinance private account within three months.

The discount does not apply if you change your banking package from Smart to SmartPlus and back within two years. The discount will also no longer be valid if you cancel and take out new insurance for the same object.

The discount does not apply to property insurance for which Great Lake Insurance SE is involved as the insurer. -

Yes, however, PostFinance focuses on the Swiss market area. As a customer resident abroad, you can only access a limited range of products for regulatory reasons.

For customers resident abroad, a monthly fee of CHF 25 per payment transactions account will be charged additionally. -

Yes, you can open a banking package for a joint account as a couple or a family. For individual accounts for adults, you open separate banking packages for each person. The free banking packages Smart Kids (for children up to 11 years of age), SmartYoung and SmartStudents are available for accounts for children and young people.