PostFinance credit cards

Your card with attractive extras

You are here:

With PostFinance Mastercard® and Visa credit cards, you get money back on all purchases. Order online now and benefit from your first purchase.

PostFinance credit cards: stress-free while on the go

-

- Cashback of up to 1%

-

- Accepted worldwide

-

Mobile payment

-

- Comprehensive insurance for shopping and travel

In detail

Excellent customer satisfaction

Our customers rated PostFinance credit cards “Very good”. Convince yourself of our services.

PostFinance credit cards: your reliable companions

Questions and answers

-

Persons over the age of 18 resident in Switzerland or Liechtenstein can apply for a credit card. To order a credit card, you need a PostFinance banking package with a private account in Swiss francs.

-

No. PostFinance credit cards are only available with a banking package (Smart, SmartPlus, SmartYoung or SmartStudents). You can arrange the products in your banking package as you want.

-

When using debit cards, every payment is debited from your account immediately. With a credit card, you only pay at the end of the month (partial payment possible) – the bank gives you short-term credit.

You also enjoy the following advantages with our credit cards:

- Bonus programme: up to 1 percent cashback on every purchase.

- Reservation guarantee: often debit cards are not accepted for booking accommodation, rental cars or flights. But a credit card guarantees the reservation.

- Insurance coverage: shopping insurance and – depending on the credit card – travel insurance are included.

- Discounts: money off car rental with Avis.

- Exclusively with Platinum: value-added services such as concierge service and airport lounge access.

-

The only difference is acceptance: some retailers don’t accept both card types. You can see which cards are accepted at the in-store or online checkouts.

-

Yes. You can make mobile payments with your PostFinance credit card. Store your card in a supported wallet such as Apple Pay, Google Pay or Samsung Pay. You can then make contactless payments with your smartphone or smartwatch wherever you see the relevant symbol or mobile payment logo.

-

Your limit is set individually based on your financial situation.

-

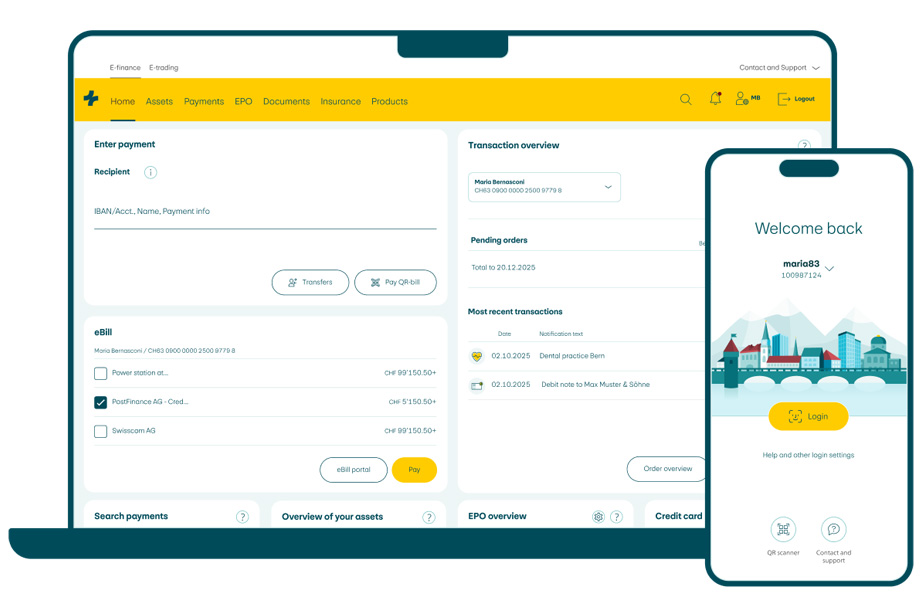

You can manage your credit card conveniently in e-finance under “My cards” (e.g. block credit card).

You can find help with card management (e.g. to adjust the withdrawal limit) in our support area.