Depending on the period of time you wish or are able to invest for and how willing you are to assume risk (depending on your risk appetite and risk capacity ), you are one of four different types of investor: cautious, prudent, balanced or risk-taking. You can have your personal investor profile determined in a consultation, for example. This produces a recommendation on how much of your portfolio – in percentage terms – you should invest in shares to achieve a return in line with your requirements. As a general rule, the higher the risk assumed, the greater the expected return. The risk can be explained as the range of variation of the return (volatility ), in other words the uncertainty over how much return will ultimately be generated. Exactly what these fluctuations are all about and how they occur is explained in the article “Why do prices fluctuate?”

You are here:

Why shares are worthwhile

“I don’t have any shares, they are too risky.” Have you heard people saying this kind of thing? Do you even agree with them? Shares do actually entail greater risk than bonds, for example. But investing in shares can pay off, particularly for investors pursuing a long-term investment strategy. Shares ultimately give you a greater chance of high returns. The size of your share portfolio depends on your investment horizon as well as your risk capacity and risk appetite.

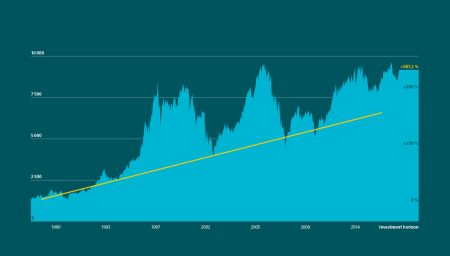

The value of the stock markets has risen historically

Avoiding shares completely is usually only advisable if you have a short investment horizon of less than four years and/or if you require a very high level of security. Most other investors are advised to put between 20% and 100% of the capital to be invested into shares. This allows them to increase the chance of achieving higher returns by assuming a bit more risk. But any investors still only hold a small number of shares in their portfolio. Lots of investors prefer bonds, which are a more secure form of investment than shares, but which generate lower returns. This also applies to those investing long-term, who could actually focus more heavily on shares. In particular, people who invest their retirement capital in retirement funds tend to adopt a rather cautious approach. This means they usually opt for funds containing a high proportion of bonds instead of focusing more heavily on shares and thus achieving higher returns. Why is that? People tend to attach more importance to particular major events in the past that they actually merit. The same is true of the stock markets. Investors remember crashes, the bursting of speculative bubbles or significant market corrections. This is despite the fact that such events only occur rarely from a long-term perspective. You can read more on this topic in the article “Psychological pitfalls to avoid when investing”. The value of the stock markets has continually risen historically and has also recovered after extraordinary events.

SMI – historical chart

The return on equity must be higher than the interest on debt capital

Bonds are company loans (debt capital). Entrepreneurs obviously always aim to achieve greater returns with this additional capital than it costs. In other words, the return for the company is higher than the interest that must be paid to the bondholders. Put simply, this means the return shareholders can generate should be higher than that of bondholders.

“I don’t know enough about it ...”

... is a reason that investors often give if they only have a small number of shares or none at all. You don’t need a degree or many years of experience on the stock exchange to invest in shares, especially if you’re investing through a fund instead of buying individual equities yourself. Fund providers regularly publish information on the composition of the product and modify their share selection if necessary. Asset allocation funds are a good option for investors who do not want to put all of their money into shares. The various financial instruments (shares , bonds , money market ) are weighted appropriately based on your personal investor profile without you having to put together a portfolio that reflects your profile yourself. The financial instruments are also spread across several companies from different sectors and – depending on the fund – countries. Such diversification also reduces risk.

Don’t be afraid of shares

Generally speaking, there’s no need to be afraid of shares! Long-term investors in particular should not allow themselves to be influenced by particular historical events. If you still feel uncertain, it may be worth investing some of your capital in an asset allocation fund with a high share weighting and monitoring how well it performs.