At a glance

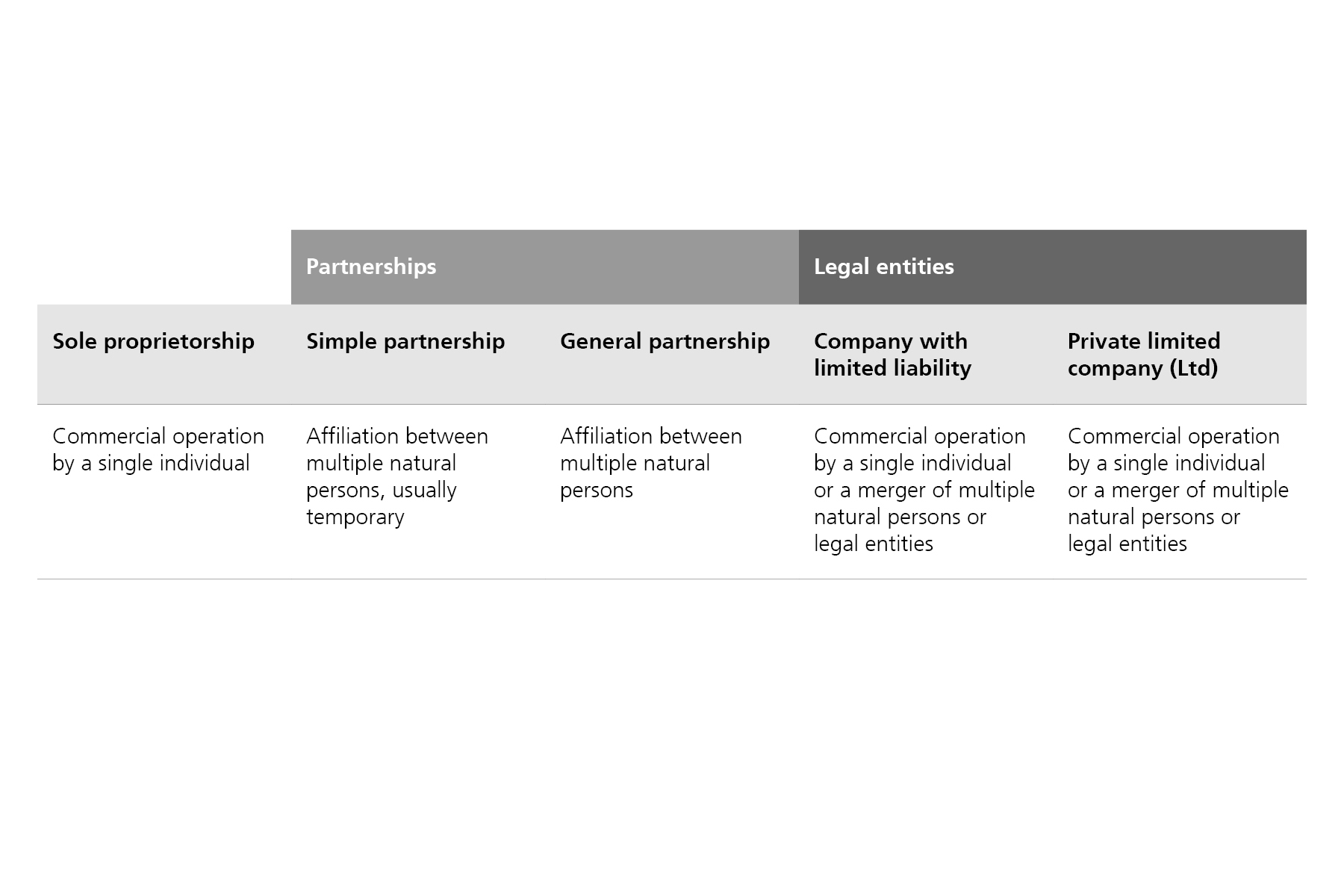

- The choice of legal form – from sole proprietorship through to private limited company – determines the liability, founding costs and organizational requirements of a company in Switzerland.

- Sole proprietorships and partnerships are often easier and more cost-effective to found, but offer less liability protection than legal entities such as limited liability companies (GmbH) or private limited companies (AG/Ltd).

- The decision also depends on the company’s growth plans and financial risks – legal entities are particularly suitable for companies with a high risk of loss and greater growth ambitions.

Everything you need to know to get started in business: subscribe to our business newsletter.